Contents

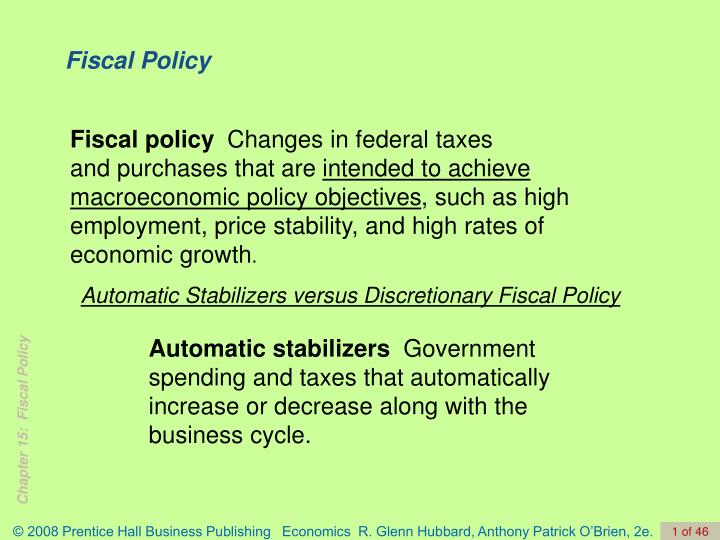

Interest on Drawings – No Interest is to be charged on Drawings. Interest on Loan & Advances by a partner – Interest @ 6% p.a. Is to be allowed on Advances & Loans, according to section [Sec. Treatment of losses arising out of the insolvency of a Partner. Procedure by which a partner may retire and the method of payment of his dues. Ratio in which profit or Losses are to be shared.

But the Balance of Fixed capital is always Credit Balance. In case of any partner gave loan to his firm, that partner is entitled to an interest on that given loan at a pre-decided rate of interest. If there is no agreement for the rate of interest on loan, the partner is entitled to Interest on loan @ 6% p.a.

It is prepared to show how the profit available for appropriation has been appropriated among different items such as interest on capitals, partners’ remunerations in the form of salary, commissions, etc. The change in the balance of an account over time can be seen in the profit and loss statement or the income statement. On the other hand, the balance sheet is a snapshot of the company’s financial condition at a particular time. It reports both the assets and the liabilities of the business. A comparison must be made between the company’s income and cash flow statements since the accrual accounting method permits a business to record sales and expenses before paying those amounts.

Items that are not considered as appropriation

Khatabook will not be liable for any false, inaccurate or incomplete information present on the website. The company generates revenue by collecting interest on drawings. Interest will be charged to the partner on any amount of cash withdrawn from the firm during the year.

They introduced capital of Rs. 5,00,000 and Rs. 3,00,000 respectively. On 31st October, 2009, A advanced Rs. 2,00,000 by way of loan to the firm without any agreement as to interest. Debit side of Trading AccountItemsDescriptionOpening StockThis includes the closing balance inventory carried forwarded from previous period.

- Although all organisations produce profit and loss accounts, partnerships are the most likely to prepare the appropriation accounts.

- Find important definitions, questions, meanings, examples, exercises and tests below for What is work extension?

- The goods could be manufactured and sold.Other ExpensesAll expenses which are not directly related to the main business activity will be reflected in the P & L component.

- The profit of the firm for the year ended 31st March, 2008 was Rs. 1,46,000.

- The expenses covered here are mostly related to administrative, selling and distribution expenses.

Only partnership businesses are allowed to create it. Following transactions between firm and partners are termed as appropriation. You have so far studies proprietorship in 11th class. In proprietorship there is only a single owner of the business. After this, the profit earned is distributed among owners of the business and such distribution is made through a separate account which is ‘Profit and Loss Appropriation Account’. Also, this account creates a line of difference among business expense and amount given to owner, so that investors can have an insight to the distribution made.

What is in a P&L statement?

A profit and loss account, also known as an income statement, is one of the three financial statements that make up an organisation. It summarises an organisation’s revenues and expenses to determine whether it made a net profit or a net loss during a given period. Although all organisations produce profit and loss accounts, partnerships are the most likely to prepare the appropriation accounts. During the preparation of an income statement, an organisation’s net profit or loss is determined.

So in order to distribute profit among partner profit and loss appropriation account is prepared. When partnership agreement is silent as to providing Interest on CapitalInterest on capital is not allowed2. When partnership agreement is providing Interest on Capital “as a Charge” it means it is allowed even in case of the extension of profit and loss account is lossInterest on capital is allowed out of profit as well as from loss.3. This account is prepared to distribute profit or loss among the partners. This account show what amount of profit is transferred to partner’s capital Account. A profit and Loss Account is the secondfinancial statementprepared by an organization.

Salary or commission to a partner is an appropriation out of profits and not in charge against the profit. We can say that it is to be allowed only there are profit in the business. Salary or Commission to a partner will be allowed if the partnership agreement is said.

The profit and loss appropriation account is an extension of profit and loss account prepared for the purpose of adjusting the transactions relating to amounts due to and amounts due from partners. It is credited with net profit, interest on drawings and it is debited with interest on capital, salary and other remuneration to the partners. The balance being the profit or loss is transferred to the partners’ capital or current account in the profit sharing ratio. The profit and loss appropriation account is an extension of the profit and loss account prepared for the purpose of adjusting the transactions relating to amounts due to and amounts due from partners. The balance being the profit or loss is transferred to the partners’ capital or current account in the profit-sharing ratio. A and B were partners in a firm sharing profits and losses in the ratio of their capitals which were Rs. 5,00,000 and Rs. 4,00,000 respectively.

Example of Profit and Loss Statement

The income is earned when goods or services are sold to customers. If there is any return, it should be deducted from the sales value. On completion, it gets depreciated if it’s a capital Asset or taken to Profit and Loss Account if its a Trading Asset. Interest on capital is to be allowed at 5% per annum. Accounting software is an integral part of the computerized accounting system. The accounting software should be selected after considering the level of skill and proficiency of the accounting professionals.

The regular business expenses we do are not the distribution of profit, but recovering of cost. Hence, by preparing ‘Profit and Loss Account’, the net profit is found out, which is total amount received on sales less expenses incurred to receive it. Accounting Treatment – Interest on drawings is profit or gain to the Firm and credited to the Profit& Loss Appropriation Account. On the other hand, interest on drawings is a loss to the partner and debits to his Current/Capitals Account.

The purpose of a profit-and-loss (P&L) appropriation account is, by its very nature, to provide evidence of the split or distribution of profit or loss among the owners. Immediately after preparing the profit and loss account comes to the preparation of this account. As a result, it fills the role of augmentation to the profit and loss statement of the company. As it is a nominal account, all of the company’s expenses are debited, and its profits are credited.

Important Questions for CBSE Class 12 Accountancy Profit and Loss Appropriation Account

Interests on Drawing are allowed to partners only when it is provided by an Agreement or agreed by all partners. Agreement to Share profits does not necessarily mean an agreement to share Losses. A minor can be admitted to the benefits of partnership in an Existing Firm with the Consent of Majority of a Partnership. A Firm is the collective name under which partners carries its business. The partnership Deed is must be signed by all partners. The balance of Partner Current A/c and Partners Capital Account may be Debit balance as well as credit balance.

This account is prepared to ascertain the net results of a firm in form of net profit earned or net loss incurred during an accounting period. When company Charge Interest on Drawing – Interest on Drawings will be charged from the partners if the partnership agreement provides for the same. If partnership deed is silent about charging interest on drawings, No interest on Drawings will charge. From legal https://1investing.in/ point of view a partnership firm has no separate legal entity apart from the partners constituting it but from accounting point of view, Partnership is a separate business entity. Under section 2 of the Income-tax Act, 1961 a partnership firm is a Separate person. As a result, most businesses have automated the process of preparing the profit and loss statement using business management software.

Why Profit and Loss Appropriation Account is prepared in partnership Firm. A partnership deed is based on an agreement among the partners. Profit and Loss Account is a type of financial statement which reflects the outcome of business activities during an accounting period. The word ‘Partnership’ in the layman sense implies an agreement between two people to work together or jointly. In accountancy, the meaning of partnership is similar to that in the general sense but with a greater depth. For the latest updates, news blogs, and articles related to micro, small and medium businesses , business tips, income tax, GST, salary, and accounting.

Steps to Prepare Profit and Loss Appropriation Account

Following are the features of profit and loss appropriation account. A, B and C were partners in a firm having capitals of Rs. 60,000, Rs. 60,000 and ? Their current account balances were A Rs.10,000, B Rs. 5,000 and C Rs. 2,000 . Pass a journal entry for the distribution of the profit between the partners and prepare the capital accounts of both the partners and loan account of ‘A’.